Governance Training for Young Leaders

Financial Oversight

Objectives

Understand the fiduciary role of a board member as well as the types of activities they are responsible for

-

-

- Who are the key players with regards to financial oversight like the inclusion of treasurers, talent, and general “worker bees” in the board of directors, as well as how the money is managed by them

-

To gain basic financial literacy with regards to nonprofit organizations

-

-

- The Basics: how to read audits, checks, and statements; fundraising (managing and managing the donations in the pipeline, in’s and out’s of fundraising and how to get that money and not anything to do with the ethics behind that) and how much money is expected (what are the expectations of money coming in) and what is an endowment

- How to get people to pay attention and prioritize money handling and processes

-

Understand the legal and ethical considerations of financial management

-

-

- How to keep the money in the organization and stay ethical about money management

-

Understanding the difference between guidelines and policies

- Important financial policies to consider

-

Understand the fiduciary role of a board member as well as the types of activities they are responsible for

Financial management includes a board of directors that consists of members below. All of these members however, have a duty to ensure that the assets of a charitable nonprofit organization are in accordance with donors (something a nonprofit is highly reliant on and we will later establish) and that no single person is unilaterally responsible for cash management.

Key players of financial oversight, defined:

- CFO/Board Treasurer (Chief Financial Officer) – mainly oversees the financial branch of the organization and reports to the Executive Director

- Finance Director – oversees financial management and is in charge of day-today operations

- Controller, CPA/Auditor – oversees contact within audits

- Accounting Manager – oversees processing of accounts payable, staff payroll, ledger reconciliations, and accountants.

- General/Staff Accountants – oversees day-today accounting (e.g. journal transactions, billing, and accounts payable)

- Accounts Payable Specialist – oversees overall financial data entry

- Billing Coordinator – also oversees overall financial data entry

- Treasurer – oversees organization’s finances (usually report to the board, CFO, or Financial Director for relevant financial information. They are also responsible for the financial report and budget for the finance committee and board of directors)

How money is managed-

It is important for nonprofit organizations to employ financial management practices to build stability and flexibility. Financial losses can be avoided or quickly identified by an organization if it has basic financial control policies already implemented.

-

-

- One main practice that can be implemented can be budgeting to make sure the organization does not run out of money. These budgeting goals must be realistic and keep clear accountability.

- Another thing to keep in mind are the costs of the programs in order to make decisions about fundraising needs, contract terms, and program expansion or modification.

- Cash reserves can also come into play in case an unexpected downturn occurs where the organization can pull from during an emergency. This cash reserve should be able to at least cover six months of the organization’s costs.

- Diverse funding sources may sound good but keep in mind that different types of income may require different systems, structures, relationships, and communications.

-

To gain basic financial literacy with regards to nonprofit organizations

The Six Basics- As a financial board member you must know what audits, checks, and financial statements are and how to read them. Below will be the definitions of these financial terms and why they are important in a nonprofit organization.

1. Independent audit

Independent Audit is an examination of the financial records, accounts, business transactions, accounting practices, and internal controls of a charitable nonprofit by an “independent” auditor.

- Know that it is important for a nonprofit organization to have an independent audit to maintain financial transparency and accountability.

- Audited financial statements may also be needed to be eligible for funding.

2. Check

Check is an order written by a depositor instructing the bank to pay a specific amount to a recipient from the depositor’s bank account.

Using a check is a safer way to keep money safe and from being stolen.

3. Financial Reporting Statements

Nonprofits use four main financial reporting statements: statement of financial position (balance sheet), statement of activities (income statement), statement of cash flows and statement of functional expenses.

- The nonprofit balance sheet is based on the accounting formula, assets equal liabilities plus net assets.

- The balance sheet offers the best overall perspective on the nonprofit’s financial health and stability.

- The nonprofit statement of activities (income statement) follows the basic formula: revenues less expenses equals the change in net assets.

- A nonprofit’s revenue, gains, expenses, and losses are listed on its statement of activities.

- The statement of cash flows presents operating, investing and financing activities to show the sources and uses of cash.

- The statement of functional expenses is only used by nonprofit organizations based on the importance of monitoring expenditures.

4. Fundraising

Fundraising is soliciting donations or voluntary funds to help your organization grow and meet the needs of the community you serve

- Fundraising is a regulated activity that has certain guidelines from the IRS which can include being tax-exempt.

- When fundraising you would want to ask for three times the amount of the budget, sometimes even more.

- Make sure to thank donors and acknowledge them.

- Maintain donor privacy to stay ethical and prevent any problems.

- There must also not be a preferable donor to prevent conflict of interest.

- Nonprofit organizations are also largely funded by donations, investment income, grants, clubs, and certain entities.

5. Endowment

Endowment may generally be described as assets (usually cash accounts that are invested in equities or bonds, or other investment vehicles) set aside so that the original assets (known as the “corpus”) grow over time as a result of income earned from interest on the underlying invested funds.

- A nonprofit with an endowment shows that they are thinking long-term and building assets for its own future sustainability.

- Endowment is usually held at a community foundation or investment bank with really strict guidelines.

6. Tax document

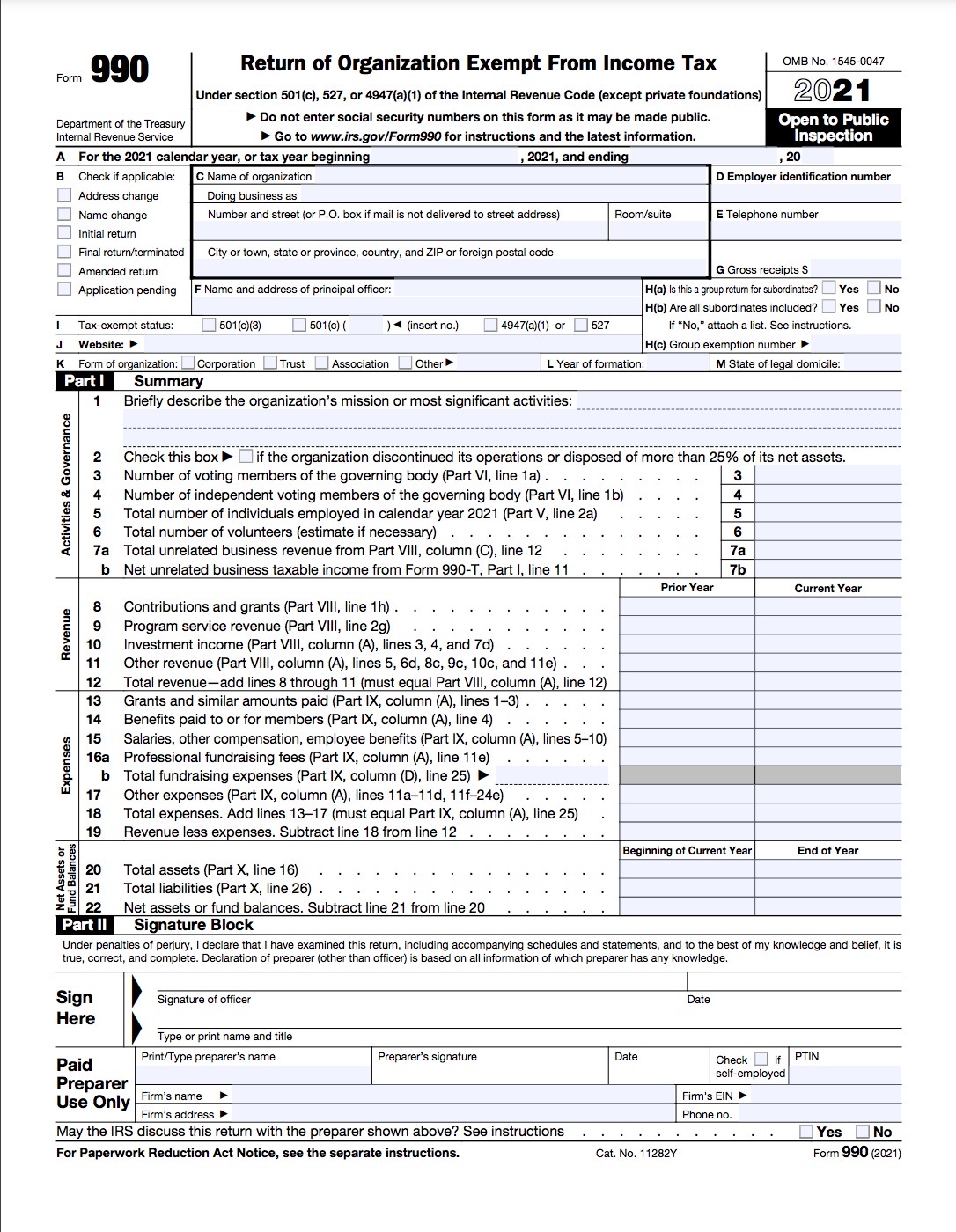

Tax document, Form 990:

- This document is needed to be filed by all nonprofit organizations as most are tax-exempt entities. This form tells the IRS what the organization does, how they govern, and anything else to do with finances.

- Having the full board to review the form before it is filed is integral to ensuring that the nonprofit is compliant with the law.

How to get people to pay attention and prioritize money handling and processes-

Although financials have much to do with hard figures and keeping in line with projected numbers, so much of getting people to care about finances has to do with understanding people. Here are some tips that will ensure your nonprofit is on the road to financial success by appealing to your team:

-

-

- Understand that it is difficult for people to pay attention to money handling for a myriad of reasons. By showing people how financials help people achieve what they want to do within the organization, financial leaders then motivate people to see the importance of staying on budget, as an example.

- Leaders must engage people in the budgeting process. Getting staff involved has to go beyond sending financial forms, and instead taking the time to meet with team members to review budgets to then build trust and demonstrate the importance of keeping a financially viable state for the organization.

- Communicate financial and governance transparency, by conveying the information reported in Form 990 filings (see taxes section) to everyone within the organization. This ensures that the team stays accountable to the mission-based programs they set to accomplish.

- Lastly, show people that financial literacy is proven to increase the success of a nonprofit organization

-

Understand the legal and ethical considerations of financial management

How to stay ethical about the money-

General practices include maintaining financial transparency, protecting donor privacy, and holding accountability.

-

-

- Financial transparency can be done through providing current and most recent IRS Form 990 and the organization’s application for tax-exemption, posting publicly available financial information about the organization, or providing ways on how donor gifts have been or will be used within the organization.

- Protecting donor privacy can be as simple as allowing a donor to be anonymous or by actively omitting donor personal financial information such as bank details or credit card information.

- Holding accountability can be done internally within an organization such as through the board disclosing financial statements, evaluations, audit reports, feedback mechanisms, and assessments. Holding accountability can also be done through the public as the general public, stakeholders, donors, or potential donors can scrutinize said organization or its leaders if or when an unethical or distrustful situation arises.

-

Ethical considerations can also be made in regards to fundraising practices.

-

-

-

- Some considerations include properly attributing, obtaining, or using photographs or videos used in fundraising or promotional activities (i.e. crediting sources, asking for permission, or ensuring that photos or videos do not include information or images of minors that could be considered personal identifying information); providing easily available financial information pertaining to the organization and fundraising efforts; honest and accurate communications; and taking into account of any state laws regarding fundraising practices.

-

-

Ethical considerations can also be made in regards to an organization’s endowment.

-

-

- Although an endowment can signal that an organization has future plans in mind, if the endowment is too large it may cause donors and the community to wonder why the endowment has grown.

- One way to ethically keep an endowment is through an Endowment Code of Conduct which includes the organization and its leaders to act with loyalty and proper purpose, act with skill, competence, prudence, and reasonable care, abide by laws, rules, regulations, and founding documents; show respect for all stakeholders, and to review investment strategy and practices regularly.

-

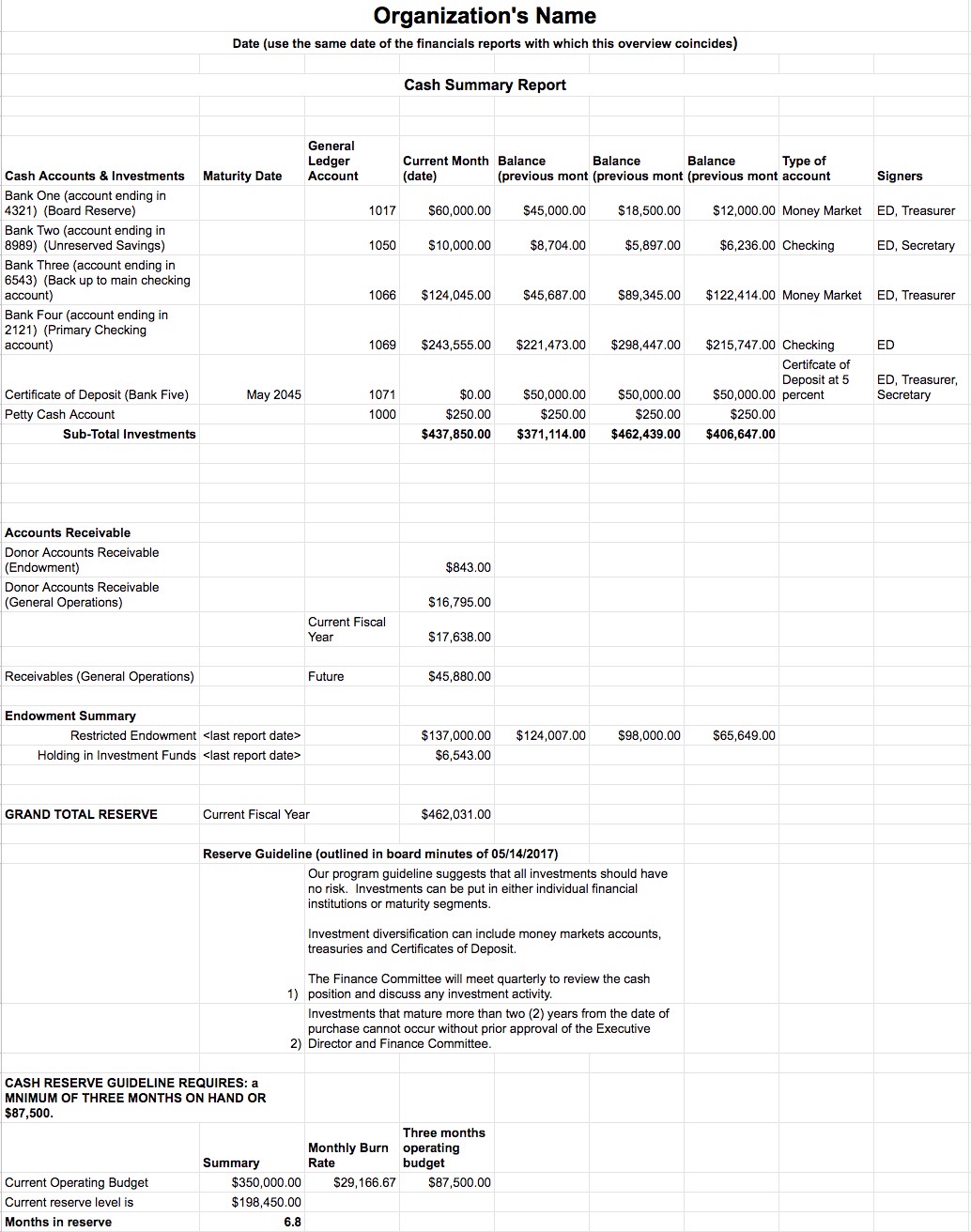

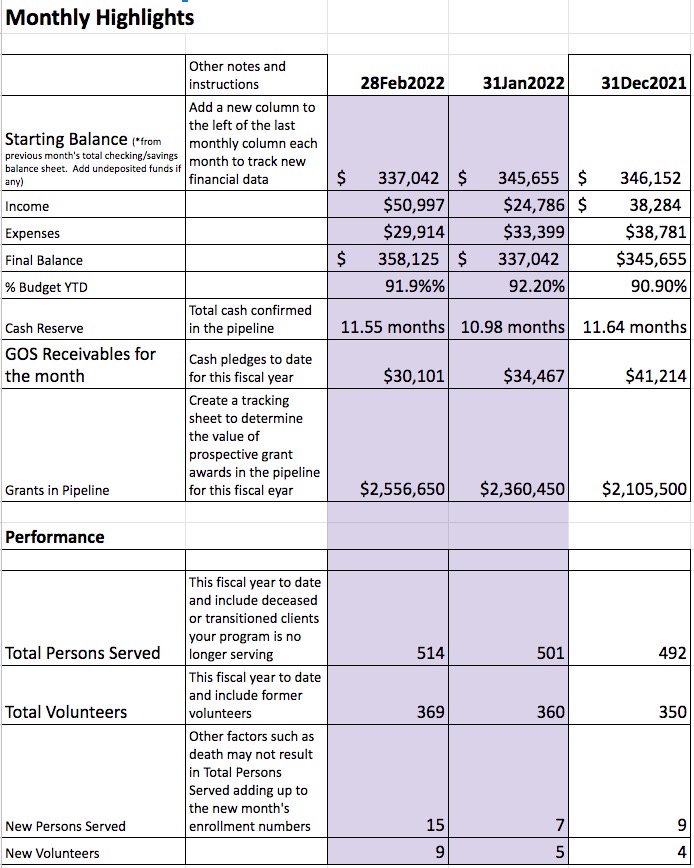

Check out these sample documents and templates

(990 form, general financial template, monthly highlight template)

Legal considerations about cash handling-

Understanding the difference between guidelines and policies:

-

-

- Most organizations have both guidelines and policies in place that guide staff in doing their jobs effectively, but the two are very different.

- Guidelines can be thought of as general recommendations. They are not mandatory or required.

- Policies are mandatory and are required either because of nonprofit values or legal requirements.

-

What is a guideline?

Guidelines give an organization the ability to guide employees through any process or task. They give recommendations of how to perform a task or advice on how to proceed in a situation.

Guidelines can be necessary in some situations but not mandatory.

Guidelines are more informal. They outline best practices, and are highly recommended but not required or regulated.

What is a policy?

Policies are formalized, high-level statements that are often created due to legal requirements or to protect the organization and its profits. In direct reflection of a nonprofit’s values and objectives, they outline roles, responsibilities, and expectations for specific programs and tasks.

Policies are enforceable and mandatory, which means there are consequences if they are not followed. Unlike guidelines, there is only one right way to follow a policy. One either followed the policy precisely, or one did not. Policies may lay out the consequences, which can include additional training, probation, or even termination, depending on the severity of the violation.

Important policies in nonprofit organizations:

Nonprofit Accounting

(different from for-profit accounting)

Must provide a financial statement representing the organization’s liabilities and assets

Must disclose future planned cash transactions and liabilities to be paid

A statement of activities should also be included as a non-profit provides community support

Conflict of Interest

Most crucial policy

Policy must be reviewed and available in writing

Individuals with conflicts should disclose the conflict to board members

Members should vote against any issue where conflict exists

State laws govern nonprofits to include rules on what is required to be included in a conflict of interest policy

Payment and Reimbursement Policies

Guidelines to indicate which board expenditures can be reimbursed

Focused on reasonable compensation for services

Nonprofit organizations are permitted to reimburse any necessary expense incurred while providing service

Compensation

Executive director compensation should be established by the board of directors

The compensation must be reasonable and not excessive

Must file IRS form 990 to describe the process used to authorize compensation

The Board of Directors is responsible for reviewing the organization’s budget with ample staff support in mind, ensuring that the organization can hire competitively within the community

Quiz

![]()