Governance Training for Young Leaders

Legal and Ethical Integrity

Objectives

-

-

- Understanding the ethical implications that may arise

- Understanding legal tax documents for nonprofits

- How to remain committed to acting ethically

- Precautions to put In place to ensure transparency and accountability

-

Introduction

This training module aims to be a resource to educate board members on legal and ethical considerations that must be in place to successfully overlook a nonprofit organization. This module will explain legal forms that nonprofits may file in order to achieve tax exempt status. This status includes regulations that nonprofits must abide by. There are regulations of finances, fundraising, and political activity; any violations can result in penalties. Ethical concerns also arise in the nonprofit sector in regards to behavior, information use, and potential conflicts of interest. It is encouraged that organizations develop guidelines to work through ethical conflicts. To prevent ethical and legal issues transparency is key. Organizations should implement preventative frameworks such as a code of ethics to refer back to in order to guide the organization. Lastly, there are real world examples of ethical and legal issues from other nonprofits to learn from their experiences.

What are the responsibilities of a board member in order to serve with integrity?

The Board of Directors is responsible for overseeing the day-to-day operations of the organization.

The Board –

Establishes the tone for the company. The ethical climate set by the Board is followed by staff and volunteers. The Board of Directors should uphold the highest ethical standards and guarantee that the organization follows all local, state, and federal laws. The Board bears primary responsibility.

The Board of Directors is accountable to:

-

- The public

- The Attorney General

- The Internal Revenue Service

- Members (if you have them)

- Donors, clients and beneficiaries

- Employees and volunteers.

Number of Directors –

The minimum number of members of the Board of Directors is determined by the governing documents and state law. The minimum number of directors required under most state regulations is three. Other criteria for Board service are specified by state law and the governing statutes (e.g., age or residency).

Term of Office –

Once elected to the Board, state law and the governing statutes establish the length of time that an individual will serve. Term limitations, on the other hand, may limit the number of times an individual can be elected.

The governing documents demand that the Board hold elections on a regular basis. A director cannot serve on the Board beyond his or her term unless the governing documents allow for reelection.

The bylaws may limit the number of terms a director can serve in addition to specifying the length of each Board term. Term restrictions are recommended for larger nonprofits because they ensure that fresh viewpoints are brought to the Board on a regular basis. Smaller organizations, on the other hand, may find it more difficult to recruit individuals to serve on the Board of Directors.

Duty of Care –

The Board must carry out its duties with the same caution that a responsible person would exercise in managing his or her personal affairs. The Board must act in good faith, remain aware and vigilant, be proactive, make solid and informed choices, and exercise independent judgment.

The Board may outsource the organization’s day-to-day management to staff and some decisions to Board committees, but the Board retains ultimate accountability. The Board may depend on information provided by employees, advice from others — attorneys, accountants, insurance specialists, and other experts working in their field – to satisfy the Duty of Care. Board committees functioning within their areas of expertise give information. However, trust must be established in good faith. Ultimately, the Board of Directors bears the responsibility for determining what is best for the organization.

Duty of Loyalty –

The Board must act in the best interests of the organization, and not for personal benefit. A Director cannot take advantage of business opportunities that would be of interest to the organization without first offering it to the organization. Boards should adopt a written conflict of interest policy, and make sure it is followed. A conflict of interest policy should: define what constitutes a conflict of interest, specify the persons to be covered by the policy, and require an annual disclosure of affiliations.

Duty of Obedience –

Directors must make sure that the organization acts in a manner that is consistent with its governing documents, mission and tax-exempt status. They must ensure that the organization complies with all federal and state laws as they apply to the organization. Also ensure that all grant requirements are being followed.

The Board is in charge of the nonprofit’s overall administration.

-

-

- The Board should convene on a regular basis to meet this criterion.

- As needed, form committees.

- Manage top management and elect officials.

- Establish policies and procedures for all parts of the program and operations.

- Ensure that all federal filings are completed on time.

- Make sure the organization is properly insured.

- Avoid micromanaging

-

The “Corporate Checkup” –

Board members should implement a company checkup on a regular basis. The Board should check the following items as part of the checkup:

-

-

- Application for Tax Exemption and Certificate of Incorporation – do they accurately reflect the organization’s current activities?

- For membership organizations: is there a current list of members? Are the members getting notice of meetings?

- Bylaws – do they accurately reflect how the organization currently operates?

- Ensure that the organization’s programs are consistent with its mission and regularly evaluate the program to ensure that it is furthering the mission.

- Ensure that the organization has a strategic plan for carrying out its mission.

- Fundraising:

- Ensure that the organization has sufficient funds to carry out its mission.

- Participate in the fundraising activities of the organization.

- Ensure that the nonprofit engages in legal and ethical fundraising practices.

-

-

-

- Finance:

- Formulate and approve operating budget with assistance of the Executive Director.

- Monitor income and expenses on a regular basis.

- Review and approve year-end financial reports.

- Retain an independent auditor and supervise the audit process.

- Establish financial management procedures – e.g., check writing, expenditure controls.

- Ensure required reports are submitted to the organization’s funders.

- Review Form 990 before it is filed with the IRS.

- Ensure tax payments are made on a timely basis.

- Finance:

-

Personnel Matters:

-

- Determine what kind of employee and other workers the organization needs to accomplish its mission.

- Hire a qualified Executive Director; evaluate his or her performance periodically.

- Set the executive director and other key employees’ compensation in according to IRS guidelines.

- Develop and implement personnel guidelines, and make sure they are followed.

- If the organization has volunteers, consider developing and implementing guidelines for them, too.

What do the tax forms mean?

A 501(c)(3) is a federal tax code that grants tax-exempt status to non profit organizations that file under the code. To qualify as a nonprofit an organization must have a public purpose and no private benefit to insiders. Organizations that file under this code are relieved from some federal and state income taxes, it also grants tax deductions for charitable contributions. Tax laws restrict income, fundraising, and political activities for tax-exempt organizations. Failure to comply with the rules can result in a loss of tax-exempt status as well as other penalties. Venable.

To ensure a nonprofits compliance with the law, they are required to file a Form 990 once every three years (Law Help). On the form income must be disclosed as well as if the mission of the organization has changed. Lack of filing annual information returns can result in tax-exempt status being revoked.

What does “Conflicts of Interest” mean?

It is essential to ensure that the organization may not offer private benefits to individuals within the organization. 501(c)(3) status requires that no part of net earnings may inure to the benefit of private shareholders. An example of a conflict of interest could be an organization offering preferential treatment to board members or affiliated companies where individual people or companies benefit (financially) from the organization. Conflicts of interest can damage organization integrity. Although they are high risk they do occur often with people involved in multiple ventures. It is important for an organization to develop robust conflict of interest guidelines. These guidelines would require employees and board members to disclose all financial interests in companies that may engage in transactions with the organization. Individuals with a conflict must remove themselves from negotiations or votes which involve the conflict. When dealing with conflicts of interest, transparency is key (Ethics and Nonprofits).

Information Privacy

Within an organization sensitive personal information may need to be utilized. An open exchange of information can be helpful to share resources to further benefit organizations but this information must be treated appropriately. It is essential to build trust and not tolerate inappropriate access or sharing of information. Organizations should continue to investigate the accuracy of information before allowing it to be used in decision making. Any confidential personal information should be safeguarded and protected. This will limit the potential for hacking or inappropriate access.

Ethical behavior comes from within

To create a space where all values align towards acting ethically it is important to start from within the organization. Having a strong sense of organizational values which are consistent with the behaviors of leaders is crucial. All employees and volunteers should also be well versed in the values of the organization therefore they can refer to them in decision making. Organizations must never tolerate inappropriate conduct which may create an uncomfortable environment, this includes inappropriate comments or jokes. Leaders should also be committed to treating their employees and volunteers with respect and ensure they are appreciated for their contributions to the organization.

How do I practice legal integrity?

Tax exemption under Section 501c3 of the Internal Revenue Code requires an organization to be organized and operated exclusively for exempt purposes charitable, religious, educational, scientific, literary, testing for public safety, fostering national or international amateur sports competition, and preventing cruelty to children or animals. The term charitable is used in its generally accepted legal sense and includes relief of the poor, the distressed, or the underprivileged; advancement of religion; advancement of education or science; erecting or maintaining public buildings, monuments, or works; lessening the burdens of government; lessening neighborhood tensions; eliminating prejudice and discrimination; defending human and civil rights secured by law; and combating community deterioration and juvenile delinquency. None of the charitable organization’s earnings may inure to any private shareholder or individual.

990 form

A tax-exempt organization must file an annual information return or notice with the IRS, unless an exception applies. Annual information returns include Form 990, Form 990-EZ and Form 990-PF. Form 990-N (e-Postcard) is an annual notice. Form 990 is the IRS’ primary tool for gathering information about tax-exempt organizations, educating organizations about tax law requirements and promoting compliance. Organizations also use the Form 990 to share information with the public about their programs. Most states rely on the Form 990 to perform charitable and other regulatory oversight and to satisfy state income tax filing requirements for organizations claiming exemption from state income tax.

Finances

In order for nonprofit organizations to keep finances in order, an annual report should be reported that often includes a financial overview, including a breakdown of revenues and expenses, changes over the past year (such as investments in infrastructure or the sale of assets), and sources of income.

Financial audits

A financial audit (for all organizations with annual revenue over $250K) and management letter—should be available by request from the organization. The financial audit can be considered a “triage tool” that will help assess the organization’s financial security based on its cash income. The financial audit includes footnotes to help the reader interpret the balance sheet, income statement, and cash flow statement.

Fundraising

Some typical fundraising events might include: dinners/dances, door-to-door sales of merchandise, concerts, carnivals, sports events, and auctions. Some fundraising activities, such as volunteer-operated bake sales, may meet this exception. This exclusion is strictly limited to transactions with members, students, patients, officers, and employees. Any business selling merchandise, which is donated to the organization, is not taxed. Only when unrelated activities are substantial compared to all of the organization’s exempt activities, that those activities jeopardize an organization’s tax-exempt status. Many require charities to register with a state agency before asking for contributions from state residents. A qualified charity must conduct the event. This allows the donor to document that the gift was to a charity recognized by the IRS. If a person or organization other than the charity is conducting the event, the charity must clearly authorize the person to act as its agent. Sponsorships are considered a business deal but the money given to a charity often is not taxable because it’s not considered to be from a regularly carried on trade or business. Organizations are required to provide a written acknowledgement of the in-kind donation if the value of the donated item is over $250. Donations greater than $5,000 require that the organization complete Part IV of Form 8283.

Lobbying and political activity scope

Nonprofits are able to lobby but can’t make it the organization’s main goal. There is an expenditure test to determine if the activities are substantial. The Form 5768 titled, “Election/Revocation of Election by an Eligible Section 501(c)(3) Organization To Make

Expenditures To Influence Legislation” exists to verify where the organization is spending too much on lobbying and may therefore lose their tax exempt status. Additionally, organizations are prohibited from directly or indirectly participating in, or intervening with any political campaign on behalf of any candidate running for public office. They are unable to contribute to campaign funds and can’t engage in activities in favor or in opposition for any candidate, but can encourage voter participation.

Copyright

Organization’s cannot post any copyrighted content without permission unless it is in the public domain. Public domain or copyrighted content can be used depending on: (1) the purpose of the use, (2) the nature of the copyrighted work, (3) the amount and substantiality of the portion used, and (4) the effect of the use upon the potential market for the copyrighted work. Be sure your local program has a photo release for all volunteers and people served. NVCN offers a variety of templates that can be accepted for use by your local program.

Social media

Nonprofit organizations can prohibit certain types of social media use that involve bullying and harassment. Conduct and ethics that the nonprofit organizations would like their employees to abide by can also be enforced. Legal permission for photographs should always be provided before posting to social media.

Preventing legal and ethical issues

Code of Ethics

The organization should have a code of ethics or a statement of values. The purpose of this code of ethics is so that employees, volunteers and board members have a set of good principles that will guide ethical decision making for the organization. A code of ethics or the statement of values should promote honesty, integrity, transparency, and confidentiality. Board members have a fiduciary duty to the organization so in the event of any legal transgressions board members will be held accountable so it is in their best interest to promote ethical behaviors.

Transparency and Accountability

The organization should have transparency in all their dealings and accountability for everyone involved from the board members to the volunteers. Transparency helps encourage openness within the organization, this helps develop respect and integrity. Transparency can also help show the public that the organization is trustworthy. Ethical and legal audits should be in place so that the organization can periodically be checked on by an outside source. In order to be sure that legal and ethical guidelines are being followed, it is best when audits are performed by a third party not involved with the non-profit. This is very important because it allows any legal or ethical issues that might be overlooked or covered up to be discovered.

Having Frameworks

As a board member of a non-profit organization, it is important to be aware of and practice ways to prevent legal and ethical issues. Having and following a code of ethics is the best way to prevent any illegal or unethical behavior from leaders or employees. By having a set of principles or rules to guide the non-profit it gives everyone a unique framework to follow. If issues should arise the organization’s principles will help in addressing and fixing the problems. Full transparency and accountability from the board members is also necessary. For this organization to be free of legal and ethical problems its leaders must adhere to the highest standards and professional behaviors. It is important to treat people with dignity and respect so that volunteers and employees will feel welcomed and valued. Ethical and legal audits should be in place so that the organization can periodically be checked up on by an outside source.

Things to keep in mind when coming up with a code of ethics:

-

- Adhere to highest standard of ethical and professional behavior

- Comply with the law

- Work consistently with values of the organization

- Strive to achieve highest levels of service, and social responsibility

- Advocate for the appropriate use and appreciation of human beings as employees

- Act ethically in every professional interaction

- Seek guidance if ever in doubt of ethical propriety

- Respect uniqueness and intrinsic worth of every individual

- Treat people with dignity respect and compassion

- Assure environment of inclusiveness and commitment to diversity

Confidentiality

Nonprofit organizations should develop guidelines to ensure that information is kept confidential. It is also important for there to be a safe space for internal reports of concerns within the organization. A way for individuals to disclose potential ethical or legal concerns without fear of retaliation. Federal law prohibits all corporations, including nonprofits from retaliating against employees who “blow the whistle” on their employer.

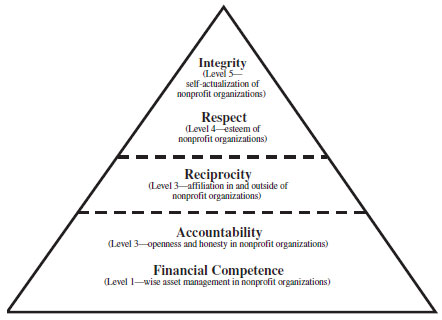

From Strickland, R. A., & Vaughan, S. K. (2008). The Hierarchy Of Ethical Values in Nonprofit Organizations: A Framework For an Ethical, Self-Actualized Organizational Culture. Public Integrity, 10(3), 233-252.

Anecdotes of Legal and Ethical Issues

Personal Matters

This person served as a Board Member and a volunteer at another caregiving organization. Ask yourself, “is this someone who should hold both positions?” While he served as a volunteer, this individual would only drive senior women to assist with their activities of daily living. As the bond progressed, the senior woman thought that they had a romantic relationship occuring. Soon after, the senior woman passed away and left assets as well as some of her estate to the volunteer/board member. Of course, her family members were extremely upset and took it to the court. This is a legal issue that can affect the organization’s credibility.

A Fundraising Ethical Dilemma

Fundraising is an essential part of the 501(c)(3) sector and it is equally important to ensure all rules and regulations are being followed. A caregiving organization received a collaboration offer from another local nonprofit; initially, the caregiving organization thought it was out of the goodness of serving people; however, once the funds were raised through an event, about 70% of the funds were taken by the other organization to serve a completely different mission than the caregiving one stands for. According to The American Institute of Philanthropy and the Better Business Bureau, it is advised that nonprofits remain with at least 65% of the funds raised by the professionals. How can situations like this be avoided?

Conflict of Interest

As a board member, it is expected that no conflict of interests are present. As stated, a member cannot take advantage of business opportunities that would be of interest to the organization without first offering it to the organization. In this situation, a caregiving organization was having conflicts with an elected official (whose position is now terminated) for not wanting to collaborate with them because it is not within the organization’s scope. The caregiving organization decided to write a letter supporting their stance and wanted it signed by everyone on the Board. A member who owns a caregiving business was not performing their duty of loyalty and refused to sign – although he did not state it was due to his caregiving business, the director knew he did not want to jeopardize any business the elected official might offer him in the future. How does the Board prevent this from happening?

Am I acting with integrity?

Self Reflection Questions to ask yourself as you serve on the Board.

How have my actions contributed to the organization’s mission?

Have all legal forms been reviewed?

Are there any issues that need to be addressed to avoid legal/ethical situations?

How has accountability and transparency been practiced since I obtained my position?

Have I assured that the workplace is safe for everyone including the people we serve?

Reminding yourself of the organization’s mission and its values will help in fostering public trust and facilitate a good working environment

Conclusion

Legal and ethical integrity are vital components of being a board member. Accountability and transparency are necessary to maintain credibility and public trust. Board members need to think collectively and collaboratively when deciding what ethical values to follow. All legal forms and laws must be adhered to, it is important you are familiar with them. Setting guidelines in place, creating frameworks, adhering to a code of ethics and being proactive will help in staying true to the organization’s mission and goals

Quiz

![]()